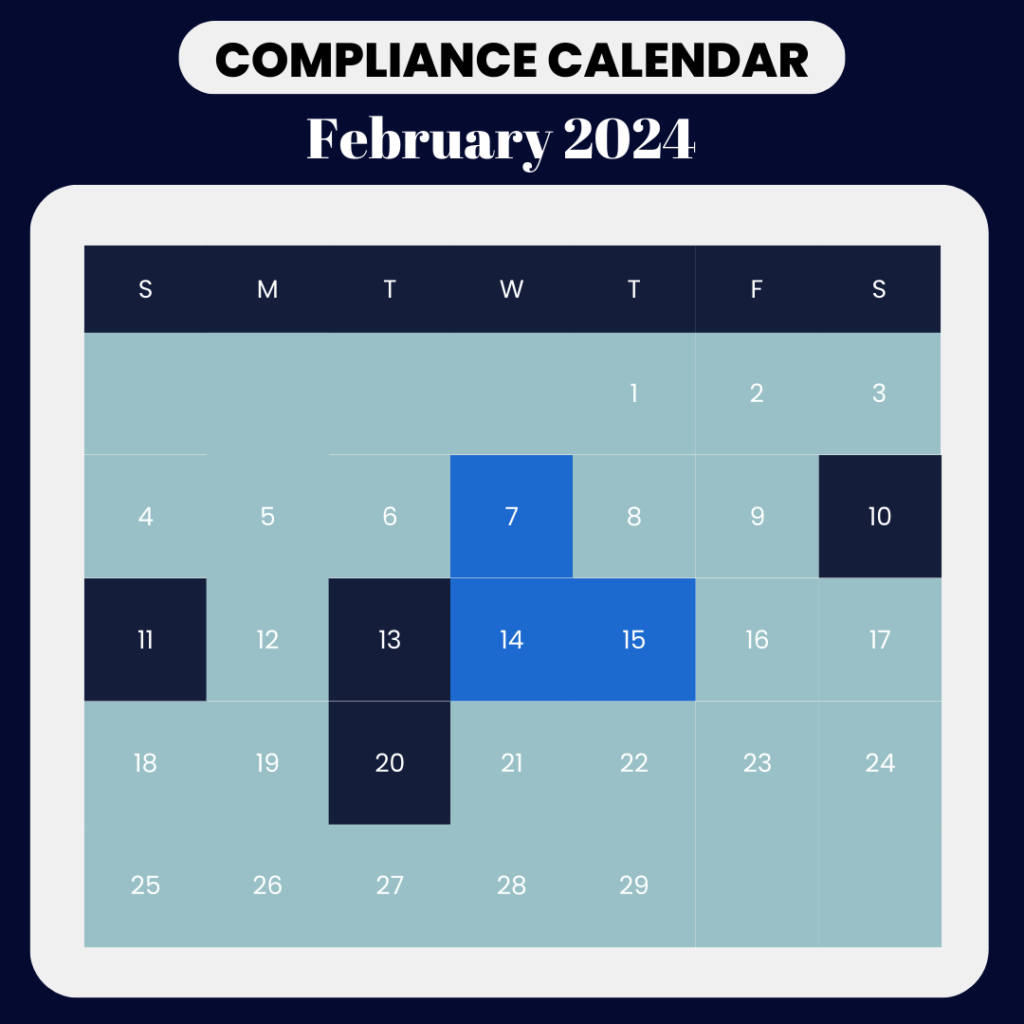

GST Compliance Calendar – February 2024:

February 10, 2024 (Saturday):

Due date for filing of Form GSTR-7 (TDS) and Form GSTR-8 (TCS)

February 11, 2024 (Sunday):

Due date for filing of Form GSTR-1 for the month of January 2024

February 13, 2024 (Tuesday):

Due date for filing Form GSTR-5 (Non Resident Taxable Person) and Form GSTR-6 (ISD)

February 20, 2024 (Tuesday):

Due date for filing of Form GSTR-3B for the month of January 2024

Income Tax Compliance Calendar – February 2024:

February 7, 2024 (Wednesday):

Due date for deposit of Tax deducted/collected for the month of January, 2024. However, all the sum deducted/collected by an office of the government shall be paid to the credit of the Central Government on the same day where tax is paid without production of an Income-tax Challan

February 14, 2024 (Wednesday):

Due date for issue of TDS Certificate for tax deducted under section 194-IA in the month of December, 2023

Due date for issue of TDS Certificate for tax deducted under section 194-IB in the month of December, 2023

Due date for issue of TDS Certificate for tax deducted under section 194M in the month of December, 2023

Due date for issue of TDS Certificate for tax deducted under section 194S (by specified person) in the month of December, 2023

February 15, 2024 (Thursday):

Due date for furnishing of Form 24G by an office of the Government where TDS/TCS for the month of January, 2024 has been paid without the production of a challan

Quarterly TDS certificate (in respect of tax deducted for payments other than salary) for the quarter ending December 31, 2023